Calculate how much a bank will lend for mortgage

If the property mortgaged is business or income-producing property you can amortize the costs over the life of the mortgage. Mortgage brokers are companies that help homebuyers shop various lenders for the best deal but dont ultimately lend the funds.

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans

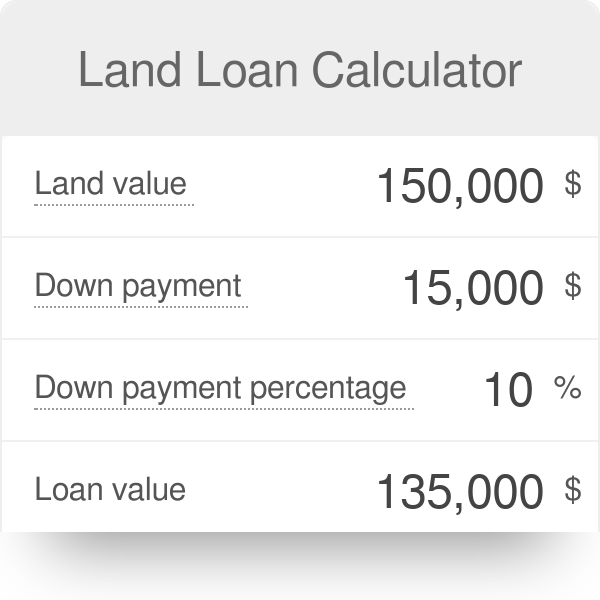

How to Calculate a Down Payment Amount.

. This is what the lender charges you to lend you the money. Estimates are based on single family owner occupied 760 credit score purchase transaction no secondary financing non-condo 60 day lock. Mortgage insurers are more likely to decline your mortgage application if.

Mortgage interest rates have been volatile throughout the summer and. This is the amount you borrowed from the lender. Interest rates are expressed as an annual percentage.

The difference between a mortgage broker and a lender is that a broker doesnt lend the funds for mortgages. To calculate the variable-rate or fixed-rate mortgage payment and get an instant estimate of how much you would have to pay for the mortgage loan we will ask you for information on a home with characteristics similar to the one you want to buy price what province it is located in if it will be your primary residence and if it is a new or existing home and details on the mortgage loan. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

Private mortgage insurance PMI is required for borrowers of conventional loans with a down payment of less than 20. Some lenders are much more strict than others when it comes to affordability and debt so its important for you to find a lender whos more lenient. A footnote on the payment schedule informs you of the rounding amount.

At the end of the mortgage term the original loan will still need to be paid back. With a Pre-Approval from Northwest Bank you can look for a home with the confidence of knowing you are already approved and what your interest rate will be. You should never be charged both a mortgage broker fee and an origination fee.

This way we dont waste your time by offering you a discounted home loan that wont be approved. This happens over time simply by making your monthly payments assuming that theyre amortized that is based on a payment schedule by which youd repay your loan in full by the end of the loan term. Find out what you can borrow.

Get a joint loan If taking on a personal loan by yourself doesnt feel right for you then a joint loan with a trusted friend close relative or your partner may be the solution. A current Index and Margin were used to calculate the rates and monthly payments below. Download our Northwest Bank Mortgage app and apply online 247 from the comfort of your home.

The mortgage should be fully paid off by the end of the full mortgage term. Certain expenses you pay to obtain a mortgage cannot be deducted as interest. The first step in buying a property is knowing the price range within your means.

These expenses which include mortgage commissions abstract fees and recording fees are capital expenses. You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a mortgage pre-approval. Rather brokers originate and close mortgage loans between lenders and borrowers.

PMI typically costs between 05 to 1 of the entire loan amount. Lending activities can be directly performed by the bank or indirectly through capital markets. In this calculator you can inclue investments annuities alimony government benefit payments in the other income sources.

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence using cash or liquid assetsLenders typically demand a. Find out how much home you can afford today. A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans.

Start your application and receive you pre-approval. You should speak to a mortgage broker before you apply to ensure youre matched with a lender whose criteria you fit. The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 581 in June 2022 according to Freddie Mac.

When it comes to calculating affordability your income debts and down payment are primary factors. For an Adjustable Rate Mortgage ARM the interest rate may increase or decrease. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

Lenders mortgage insurance LMI can be expensive. Mortgage insurance protects the mortgage lender against loss if a borrower defaults on a loan. Expenses paid to obtain a mortgage.

Calculate Your Mortgage Qualification Based on Income. With a capital and interest option you pay off the loan as well as the interest on it. Or 4 times your joint income if youre applying for a mortgage.

A Tesco Bank Loan could be a smart way to upgrade and add value to your home without adding to your mortgage. Continue to Member Broker website By selecting Continue you will be viewing content provided by a Bank of America Real Estate Center Member Broker who may have privacy practices and offer a level of security different than oursBank of America is not responsible for and does not endorse guarantee or monitor content availability viewpoints products or services that are. Unlike most mortgage brokers we work out which lenders may approve your loan before providing you with a quote.

You dont meet their genuine savings requirement. If you bought a 600000 house with a 5 deposit of 30000 then your LMI premium could cost over 22000 based on Finders LMI estimator. A mortgage pre-qualification is a rough estimate of your borrowing capacity to purchase a propertyIts calculated based on your basic financial information such as your.

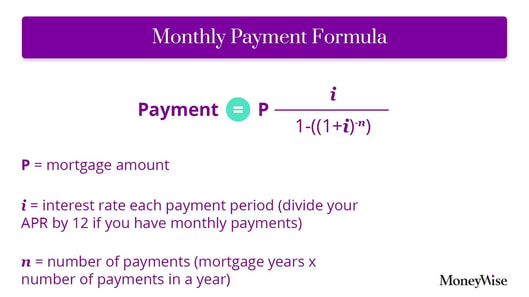

Rounding Options - due to payment and interest rounding each pay period for example payment or interest might calculate to 3450457 but a schedule will round the value to 34505 almost all loan schedules need a final rounding adjustment to bring the balance to 0. This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. 2009 financial crisis the Bank of England implemented mortgage affordability testing rules which aimed to stop banks from offering risky loans where the borrower.

One of the best ways to help reduce your loan-to-value ratio is to pay down your home loans principal on a regular basis. Most mortgage lenders will class your debt-to-income ratio as high. Factors that impact affordability.

Because banks play an important role in financial stability and the economy of a country most jurisdictions exercise a high degree of regulation. While your personal savings goals or spending habits can impact your. Mortgage broker fee 0-1 of the loan amount This fee is the same as an origination fee but is charged by mortgage brokers.

With an interest only mortgage you are not actually paying off any of the loan. See how changes affect your monthly payment.

Confused With Some Of The Terms You See In A Home Loan Agreement Don T Know What A Lock In Period Or Margin Of Loan Teaching Infographic Video Marketing

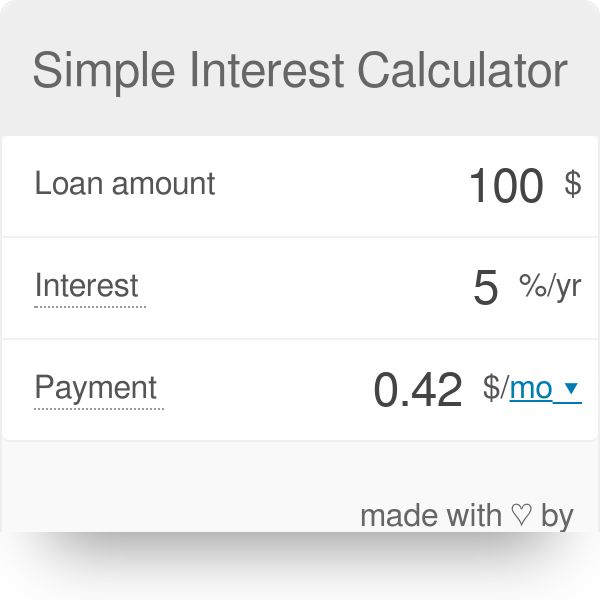

Simple Interest Calculator Defintion Formula

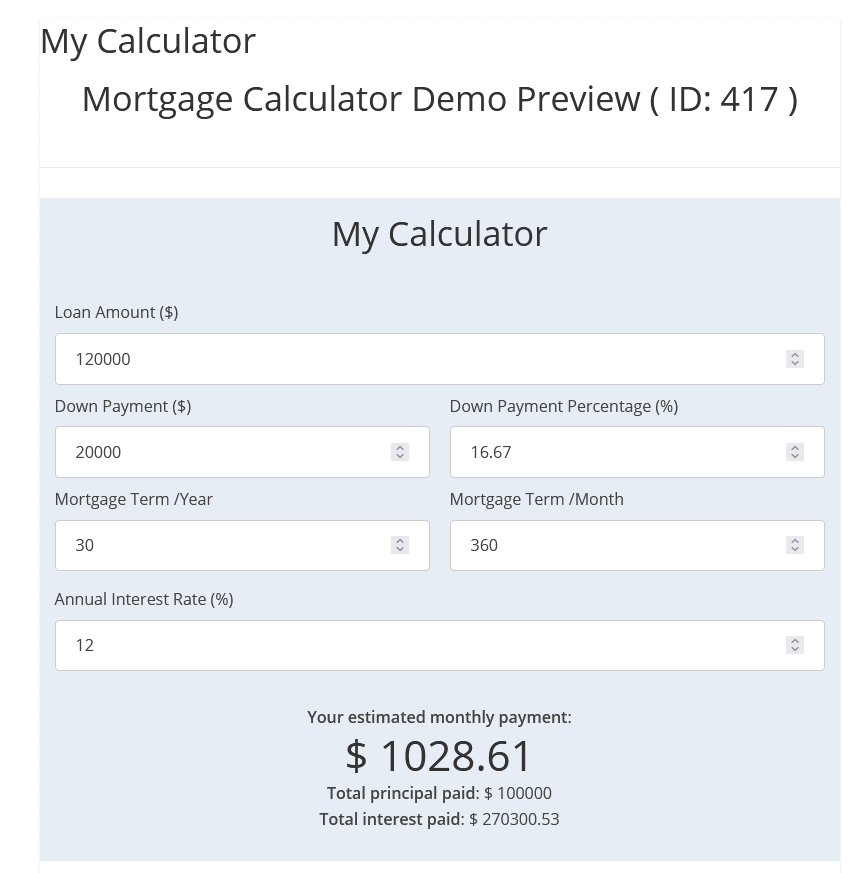

How To Calculate Mortgage On Your Site Using Mortgage Calculator Plugin

Private Mortgage Calculator 2022 Wowa Ca

Pre Approval Letter Real Estate Terms Selling House Fixed Rate Mortgage

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much House Can I Afford Buying First Home Home Mortgage Mortgage Marketing

Mortgage Calculator Canada Moneywise

Where Does The Money Come From For A Mortgage Loan Home Buying Credit Repair What Is Escrow

Fha Vs Conventional Infograhic Mortgage Loans Home Loans Fha Mortgage

Land Loan Calculator Land Mortgage Calculator

Homebuyer Tips When Applying For A Mortgage Mortgage Loans Mortgage Process Refinance Mortgage

What Is A Loan Estimate How To Read And What To Look For

A Bank Is A Place That Will Lend You Money If You Can Prove That You Don T Need It Banking Humor True Friends Quotes True Words

Loan To Value Ratio What Is It And How To Calculate It Mortgage Broker Store

Get 300 Essential Social Media Posts For Real Estate Agents Marketing Strategy Social Media Social Media Marketing Social Media Planner

How To Calculate Interest On A Private Mortgage Mortgage Broker Store